Contents:

You might focus on breakouts on https://trading-market.org/ and get an understanding how the ranges initially form, what time of day that occurs, what is going on in other markets. Then as it approaches the extreme of the range, you may see an increase in trade volume as it moves to the top. You may not how far the market moves after a break, how to know a break is failing after the bids/offers on the other side hold. Markets Access a variety of free information and resources to help you trade the futures markets. Browse through the list of contracts to find the latest information, including history, contract specifications, market news and more.

A Day in the Educational Life of an ETF Nerd at Exchange – ETF Trends

A Day in the Educational Life of an ETF Nerd at Exchange.

Posted: Mon, 13 Feb 2023 08:00:00 GMT [source]

Getting started in the different futures markets can seem daunting. One way that you can learn as you go without putting any of your money at risk is to start out paper trading. Paper trading is done by mimicking trades by yourself until you feel that you are comfortable enough to begin actually trading.

Your step-by-step guide to trading futures

Choosing the right futures broker is key when getting started. Some brokers have better futures charts than others, while others offer better futures margin requirements. There are a lot of futures brokers but some are better than others. Again, it’s a matter of whether you are going to be trading e-mini futures or micro futures. Many of the big brokers are good to use, however, there are some unknown brokers that have some benefits, especially when trading micro futures. The great news is that there are brokers that allow you to trade e-mini futures with a lot less futures margin requirement and they are good futures brokers.

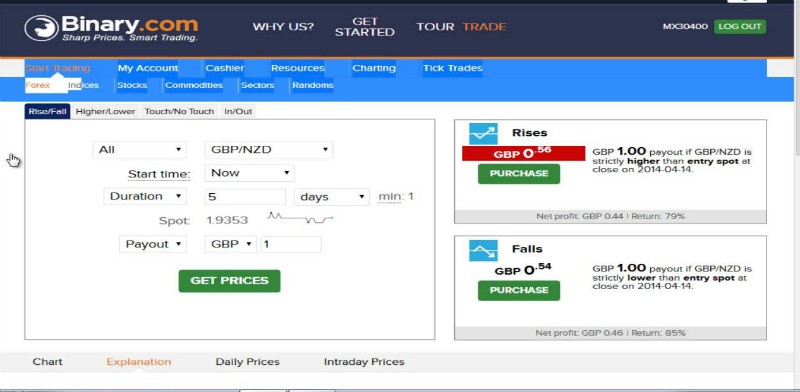

Some of the most important aspects to choosing the right broker includes margin requirements, order execution, and how good their charts are. OTC DerivativesOver the counter is the process of stock trading for the companies that don’t hold a place on formal exchange listings. The broker-dealer network facilitates such decentralized trading of derivatives, equity and debt instruments. Bull MarketsA bull market occurs when many stock prices rise 20% from a recent low, with the price climb spanning for an extended period. Therefore, this book reveals such tactics and their implementation with relatively simplistic models.

- The bid is the price at which someone is willing to buy a security.

- CBOE’s Options Institute offers courses in options trading strategy.

- Obviously you have news risk in any market you’re going to trade.

- This course will deepen your understanding of margin, contract agreements, and ways of navigating the futures market.

- Futures statements are generated both monthly and daily when there is activity in your account.

In the world of https://forexaggregator.com/ trading, success can mean significant profits—but mistakes can be extremely costly. That’s why it’s so important to have a strategy in place before you start trading. CBOE’s Options Institute offers courses in options trading strategy. Find 25 proven strategies to use in trading options on futures.

Who Trades Futures

System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. An option is a contract that gives you the right to buy or sell a financial instrument at a pre-set price,until a specific point in time. The holder of an option has the right to buy or sell the underlying asset at a specified price, while the seller of the option has the potential obligation to buy or sell the underlying asset. Learn what it means to open a position and how it can be closed. Moneyness is the relationship between the strike price and the market price of the underlying asset during the lifetime of an option.

This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. TradeStation Securities is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). TradeStation Securities’ SIPC coverage is available only for securities and for cash held in connection with the purchase or sale of securities, in equities and equities options accounts.

Past performance is not necessarily indicative of future results. The risk of loss in trading commodity interests can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you.

Broaden your knowledge of futures trading

Stay abreast of industry knowledge with these article tidbits written by the RJO Futures brokers and staff. Written without time-sensitivity these articles discuss enduring topics of how and when to trade. Currency symbols are /6A, /6B, /6C, /M6A, /M6B, /M6E, /J7, /6E, /6J, /6M, /E7, /6N, /6S, /DX and the futures hours are Sunday thru Friday 5 pm – 4 pm, except for /DX which is 7 pm – 4 pm. Metals symbols are /SIL, /GC, /SI, /HG, /MGC, /YG, /YI, /PL, and /PA. The futures hours for metals are Sunday thru Friday 5 pm – 4 pm. Market AwarenessMarket awareness refers to our ability to assess the entire stock and option marketplace from a macro level.

What is a Cryptocurrency ETF and How Does it Work? – Analytics Insight

What is a Cryptocurrency ETF and How Does it Work?.

Posted: Mon, 27 Feb 2023 05:11:42 GMT [source]

Tick Size – The minimum price movement of a futures contract is measured in ticks. High demand commodities are products that are normally traded in the futures market. Some examples of these commodities are gold, silver, oil, and corn. You will discuss how future curves will give you a snapshot of how much money you can earn if you acquire these high demand commodities today. Finally, you will learn the difference between Contango and backwardation and know more about the Contango theory and the normal backwardation theory. Micro futures contracts are often offered at 1/10th or even 1/5th the size of standard contracts, so you can trade with less up-front capital.

Learn Futures to Get 25$ Bonus!

Futures and forex accounts are not protected by the Securities Investor Protection Corporation . Spreads, Straddles, and other multiple-leg option orders placed online will incur $0.65 fees per contract on each leg. Orders placed by other means will have additional transaction costs. Get an introduction to trading psychology, including how to deal with losing as a part of trading and adjusting your psyche accordingly. Once you have developed a trading plan, you are ready to determine how to make buy and sell decisions.

For example, say you bought one contract of December silver at $20.00 per ounce. With a bracket order, you could set a stop loss exit at $18.00 per ounce and a profit exit at $25.00 per ounce. That way, you’re attempting to limit your risk to $2 per ounce, while maintaining a profit potential of $5 per ounce.

At the same time, dissatisfied students may post negative reviews even when the instructor wasn’t at fault. The “free” offer — One common sales technique is to offer an introductory seminar for free and then charge for more advanced training or other “required” features or services. This could seem like a logical way to try before you buy, but you could also be subjecting yourself to high-pressure sales tactics and ongoing phone calls to get you to try another seminar. Also, watch for companies that promise free seminars that turn out to be sales pitches for paid classes or investment opportunities.

Learn to Trade Futures

Speculators provide the majority of liquidity in the futures markets. As a result this allows hedgers to enter and exit the markets in a more efficient manner. Futures market trading dates back to the mid-1800s and has since been an important activity in the world of finance. It can have a great impact on all our lives as it affects the future prices of essential items such as food, energy sources, and raw materials.

Learn about futures contracts, the role of a futures exchange, who participates in this market and how a futures trade works. The best way to learn futures trading is in a course and trade room. A course will teach you the knowledge about the different strategies. Then, a futures trading room will teach you how to trade them live real-time.

- It also allows them to day trade, swing trade and short the market.

- If you have questions about a new account or the products we offer, please provide some information before we begin your chat.

- Speculators provide the majority of liquidity in the futures markets.

- JumpstartTrading.com does not track the typical results of past or current customers.

If you are a financial player, investor, or speculator who is wondering whether futures deserve a spot in your investment portfolio, you might want to check this course out. Euronext’s ”Options Investing E-Learning” series covers the 6 main topics you need to know when investing in options. This series of short animated videos is specifically designed for investors who are considering starting options trading. Now that you have learned how options work, discover how they can be used in practice. Learn about the financial performance of the positions you can take when trading options. Understand the different payoffs of calls and puts and long and short positions.

It also displays an intelligent manner of https://forexarena.net/ing all the complex financial strategies in an organized manner. HedgingHedging is a type of investment that works like insurance and protects you from any financial losses. Hedging is achieved by taking the opposing position in the market. Then one can choose from a variety of financial careers such as equity analyst, investment banking, asset management, risk management, corporate finance, and so on. Dead Cat BounceA dead cat bounce occurs when the prices of tradable assets increase temporarily after a period of decline and then fall again terribly to continue the downtrend. Unfortunately, many investors confuse this rise with an indication of recovery, leading them to invest in the asset only to incur huge losses after the prices drop further.

TD Ameritrade is not responsible for the products, services and policies of any third party. Diversification does not eliminate the risk of experiencing investment losses. For instance, suppose you expected gold prices to decline, but the cocoa market to rally.